Advertising spend is expected to grow globally this year, with inflation driving it to $727.9 billion and $3 of every $5 going to digital channels over the next three years. However, according to Dentsu’s latest biannual global forecast, digital spending is likely to slow to single-digit growth in the future.

Dentsu is predicting a 3.3% rise globally in ad investment this year—up $23 billion from 2022—followed by a further increase of 4.7% in 2024 and 3.8% in 2025. The growth forecast has been downgraded by 0.2% since last December’s report due to macroeconomic factors.

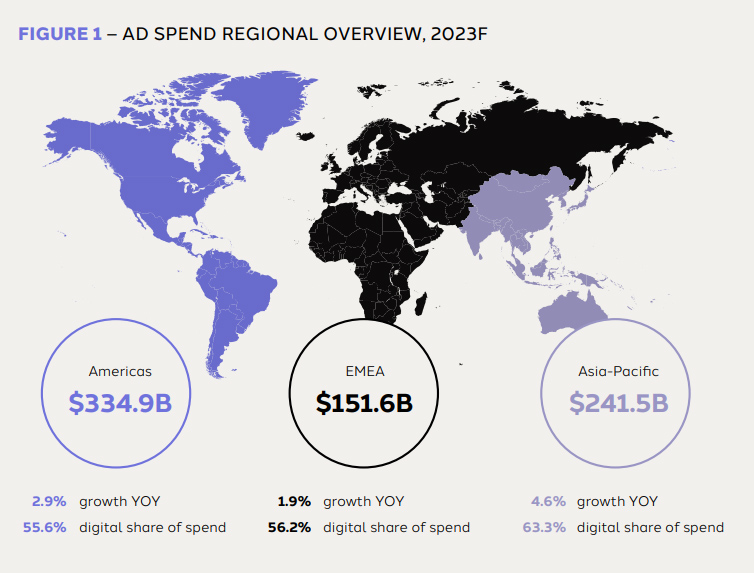

The forecasts are provided for 58 markets including the Americas, Europe, Middle East and Africa, and Asia-Pacific across digital, television, print, out-of-home, audio and cinema.

Putting on the brakes

The previous forecast from Dentsu revealed that following a period of record spend, the ad sector would see a slowdown this year and in 2024 it’s expected to accelerate again to reach $762.5 billion, partially due to the Olympics and Paralympics in Paris, the UEFA European Championship and the U.S. presidential election.

Digital ad spend will grow to $424.2 billion this year and account for 58.3% of all ad spend, increasing to 59.1% in 2024. While digital ad spend will continue to grow, it is expected to at a slower pace, 7.8% this year.

Emerging digital channels such as retail media and connected TV will remain in high demand, while programmatic buying is also set to increase by 14.4% to reach 71.4% of digital spend in 2023.

In revealing the latest forecast, Peter Huijboom, CEO of international media at Dentsu said: “For years now we’ve seen the industry pivot toward digital, more than doubling investment in the last five years thanks in part to the almost unlimited potential to reach, engage and sell to individual consumers. It has been one of the big drivers for growth, but with finite marketing budgets available to brands—it’s clear we are now starting to reach a point of digital maturation within the campaign mix alongside more traditional channels.”

He added that markets such as India, where digital was still in its “adolescence,” would continue to witness rapid growth in spending. Tech and platform innovations, alongside new channels and changed planning behaviors, would also mean that digital investment would still see “consistent growth” worldwide.

“We still expect global advertising spend to grow despite the economic uncertainty,” Huijboom highlighted in the report. “However, media price inflation is the true driver of this increase and hides the more lackluster reality: 2023 will be a flat year for ad spend.”

Asia-Pacific is projected to grow the fastest in 2023 by 4.6%, followed by the Americas by 2.9% and EMEA by 1.9%. Earlier this year, reports on the U.K. market indicated that advertising spend there would virtually stagnate, with growth in spend of only 0.5%.

Spending increases across most media

One of the categories set to decline will be TV ad spend (-3.1%) at $170.2 billion by the end of the year, with positive growth expected to return next year. Print advertising will also continue to decline by 4.8% to $48.4 billion.

Media channels set for year-over-year increases are out-of-home (3.8%), cinema (2.1%), and audio (0.8%).

Search investment will be up by 8.9% to $150 billion, with search behavior expanding from traditional search engines to social media and commerce platforms through innovation powered by artificial intelligence.

Credit:-https://www.adweek.com/agencies/global-ad-spend-on-the-rise-but-digital-growth-is-slowing/#